ny estate tax exemption 2022

For 2022 the personal federal estate tax. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

Tax Exemptions Town Of Oyster Bay

For people who pass away in 2022 the Federal exemption amount will be 1206000000.

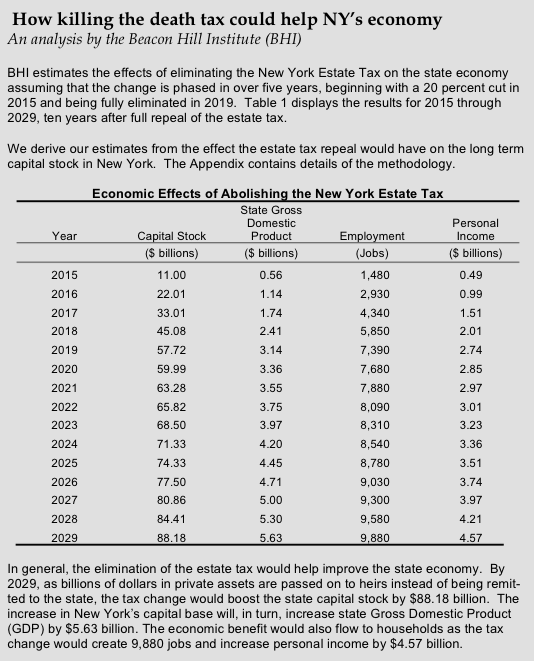

. If someone dies in September 2022 leaving a taxable estate of 7 million the estate would exceed the New York exempt amount 6110000 by 890000. This means that if a persons estate is worth less than 611 million and they die in 2022 the estate owes nothing to the state of New York. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022.

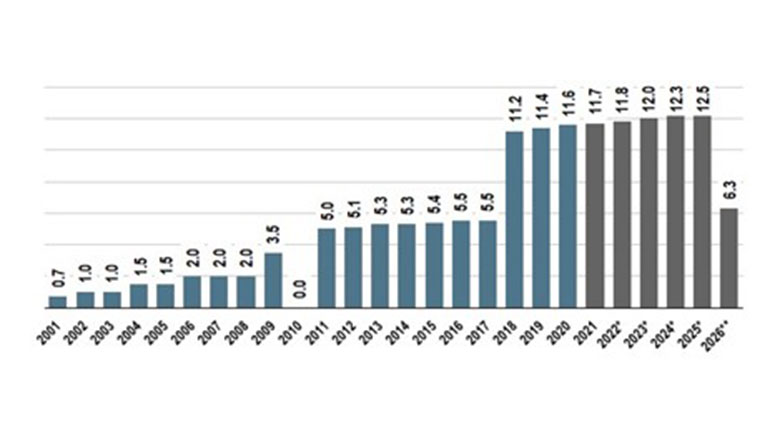

The History of the Estate. 12 rows The amount of the estate tax exemption for 2022. Get Form 1099-G for tax refunds.

We posted the basic exclusion amount for dates of death on or after January 1 2022 through December 31 2022. Due to inflation the estate tax exemption has risen this year to 126 million dollars. The information on this page is for the estates of individuals with dates of death on or after April 1 2014.

Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. New York City. New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount.

Lower Estate Tax Exemption. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. The current New York.

This is an increase from 1170000000 When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. You may need to report this information on your 2021 federal income tax return.

Here is what you need to know. For previous periods see information for dates of death on or after February 1 2000 and before April 1 2014. New York has an estate tax exemption of 5930000 for 2021.

For married couples the exclusion is now 24120000 million. That amount will now be 1206 million per person. As of January 1 2022 that will be cut in half.

New Yorks estate tax law has a significantly lower threshold. The New York estate tax exemption amount is currently 5930000 for 2021. In case the property value is 6 million there is a 70000 taxable overdue.

2022 New York Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Trusts and Estate Tax Rates of 2022. Even if a deceaseds estate is not large enough to owe federal estate tax individuals may still owe an estate tax to the state of New York.

In New York for the year 2022 a single persons estate is subject to tax beyond what New. By contrast New York taxes the entire value of an estate that exceeds the exemption by more than 105. City of New York City.

City of New York City. Visit Department of Labor for your unemployment Form 1099-G. The New York estate taxthreshold is 592 million in 2021 and 611 million in 2022.

Married couples can avoid taxes as long as the estate is valued at under 2412 million. It is anticipated to be a little over 6 million in 2022. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued between 100 and 105 of the exemption amount with no exemption being available for taxable estates in excess of 105 of the exemption amount.

That number will keep going up annually with inflation. Only a small minority of families will have to pay estate taxes to the federal government after a loved one dies. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy will pass to the heirs without any New York state tax due.

Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million. This means that if you pass away in 2022 and your estate is valued at this amount or more it will be subject to taxes. If you received an income tax refund from us for tax year 2020 view and print New York States Form 1099-G on our website.

In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000. New York State Personal Income Tax Rates and Thresholds in 2022. As of the date of this article the exact exclusion amount for 2022 has not been released.

On November 29 2021 the IRS published Revenue Procedure 2021-45 which set forth the inflation adjusted numbers for many of the provisions in the Internal Revenue Code for 2022 including the exemption amount. 16 rows What is the current exemption from New York estate tax again. New York State still does not recognize portability.

New York Estate Tax Exemption. City of New York City. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to.

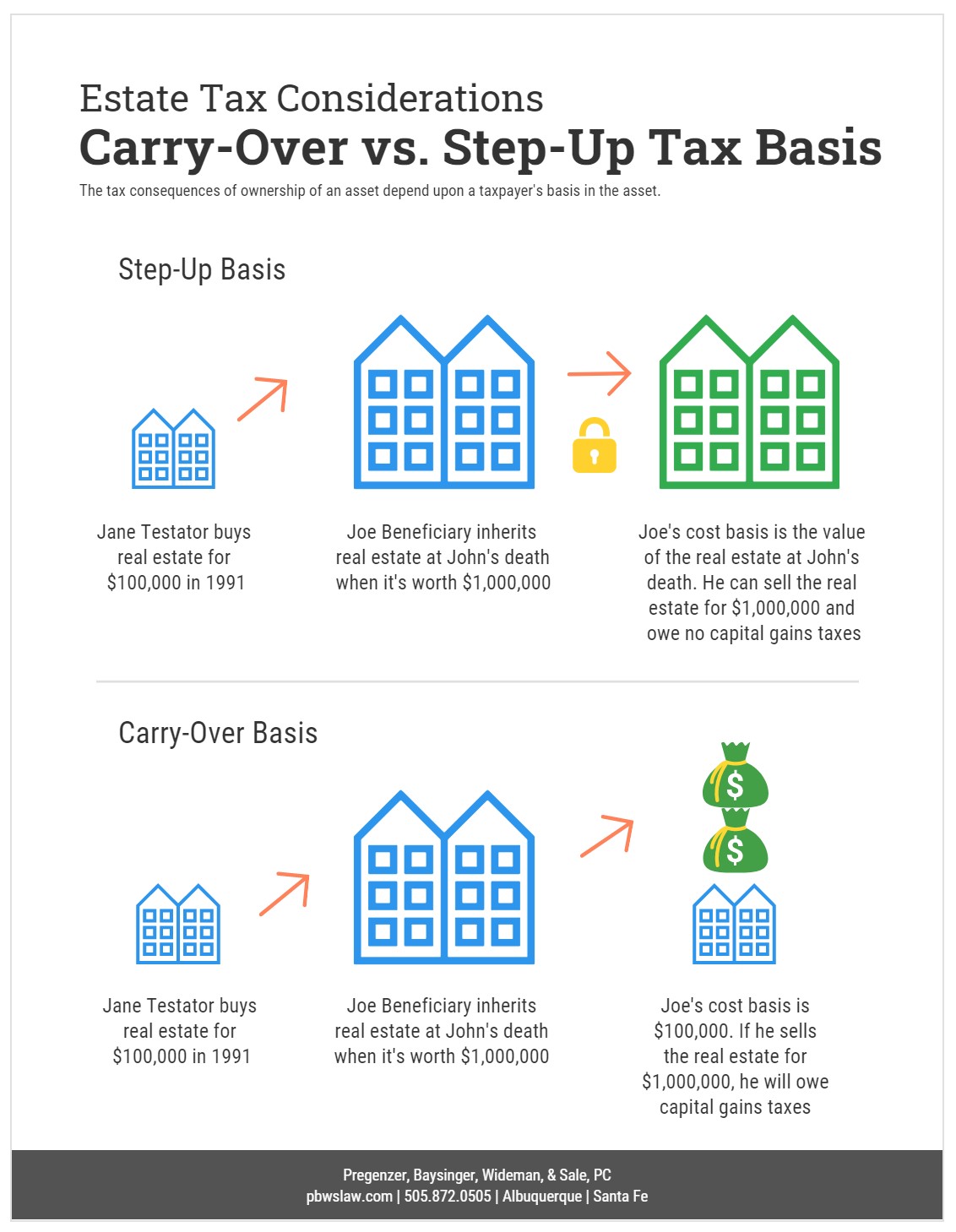

In other states the estate would pay a tax based on a percentage of the excess amount 890000 but in New. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted numbers. New York Estate Tax.

This means that a New Yorker passing away with more than the exemption amount or a non NY resident with tangible or real property in NY in excess of the exemption must pay a. Although the top New York estate tax rate.

2022 Updates To Estate And Gift Taxes Burner Law Group

Estate Taxes Under Biden Administration May See Changes

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Edgar Prado By Lynn Mara Signed And Numbered Town Sea In 2022 Prado Equine Art Lynn

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

New York Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Tax Exemption On Transfer Of Assets Between Holding And Subsidiary Company

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

New York S Death Tax The Case For Killing It Empire Center For Public Policy

![]()

Irs Tax Problems 10 Celebrities Jailed On Tax Evasion Charges Https Www Irstaxapp Com Irs Tax Problems 10 Celebrities Jailed On Tax Ev Irs Taxes Irs Jail

What Is A Homestead Exemption And How Does It Work Lendingtree

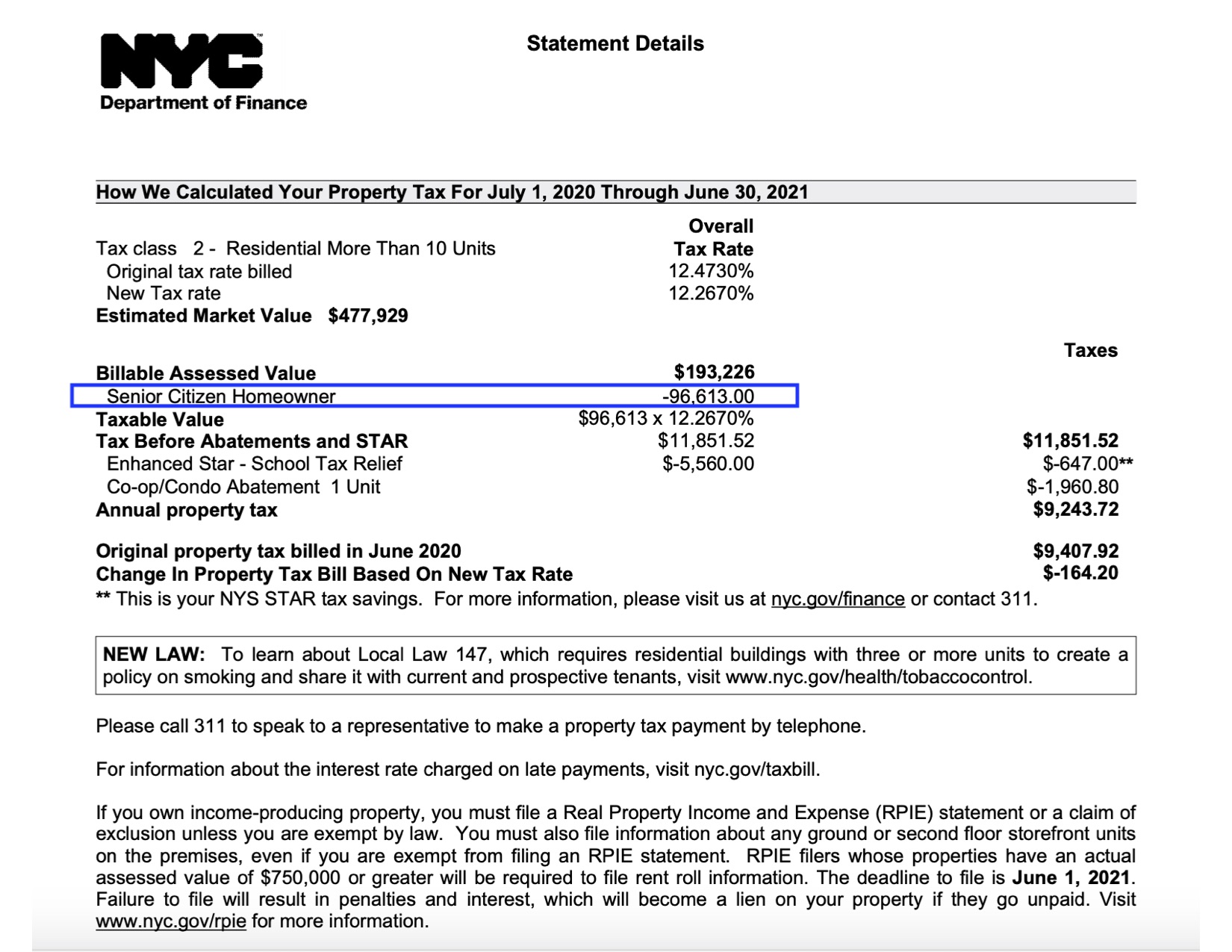

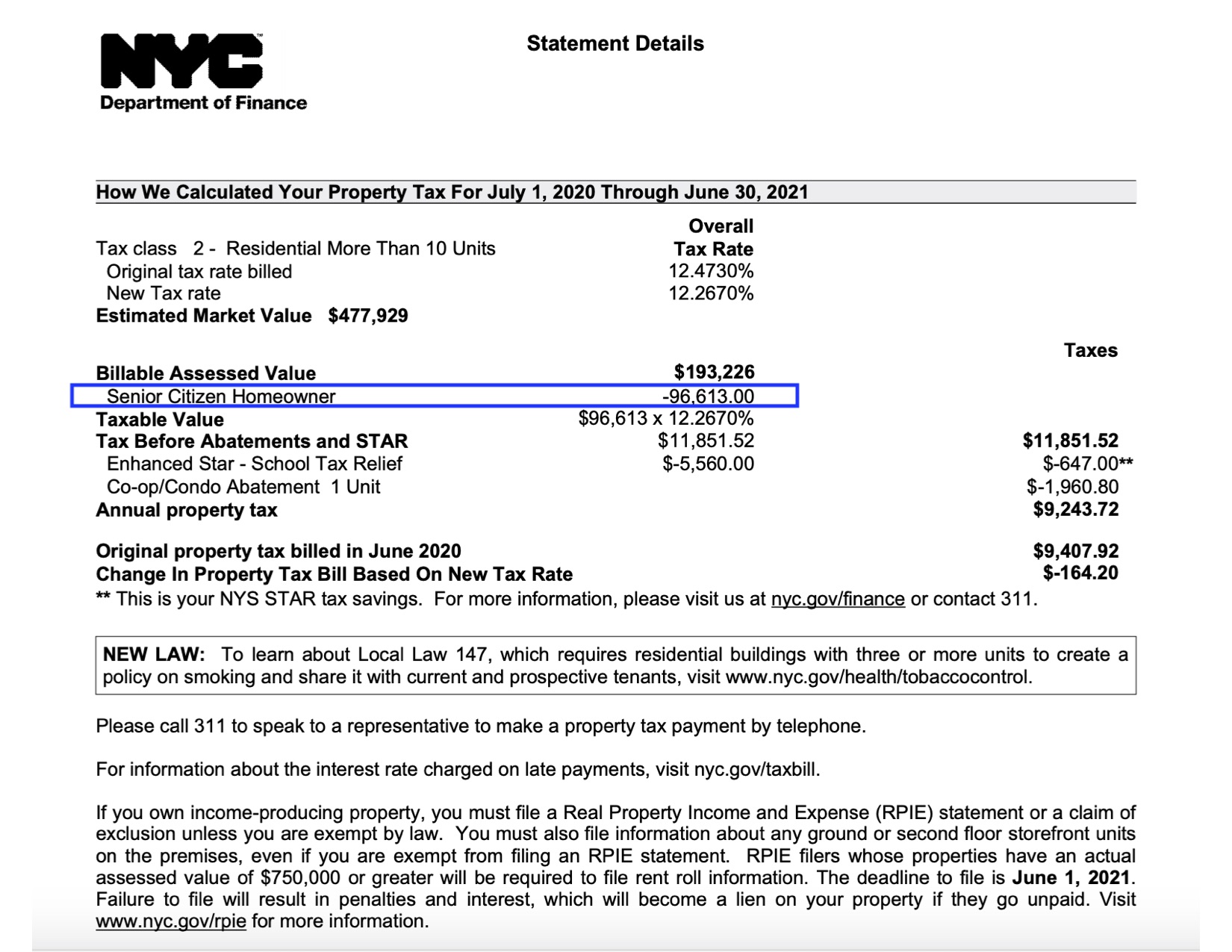

What Is The Nyc Senior Citizen Homeowners Exemption Sche

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times